Table of Contents

- Understanding different funding models is the cornerstone of any successful startup journey. This article, published by Startup INDIAX, breaks down the complexities of capital, helping founders identify the right financial strategy to secure their future.

- We delve into a range of funding options, from the self-reliant path of bootstrapping to the high-stakes world of venture capital. Readers will gain a clear understanding of the pros and cons of equity, debt, and alternative models like crowdfunding and government grants.

- Authored by seasoned experts, this guide provides data-backed insights and real-world examples, offering actionable advice to help you make informed decisions, minimize dilution, and build a sustainable business.

How to Secure Your Startup’s Future: Understanding Different Funding Models

Securing capital is often the first major hurdle for any aspiring entrepreneur. You have a brilliant idea, a solid team, and a burning desire to change the world. But how do you turn that vision into a reality? The answer lies in understanding different funding models. Choosing the wrong one can lead to unnecessary dilution, crippling debt, or even the premature end of your venture. The right choice, however, can provide the fuel your startup needs to scale rapidly and achieve its full potential.

At Startup INDIAX, we believe that informed decisions are the most powerful tool in a founder’s arsenal. This article will serve as your definitive guide to the diverse world of startup financing, from traditional methods to modern alternatives.

Decoding Startup Capital: What are the Primary Types of Funding Models?

When we talk about funding models, we’re essentially referring to the various ways a startup can raise money. Each model comes with its own set of rules, expectations, and implications for your company’s ownership and future. Let’s break down the primary categories.

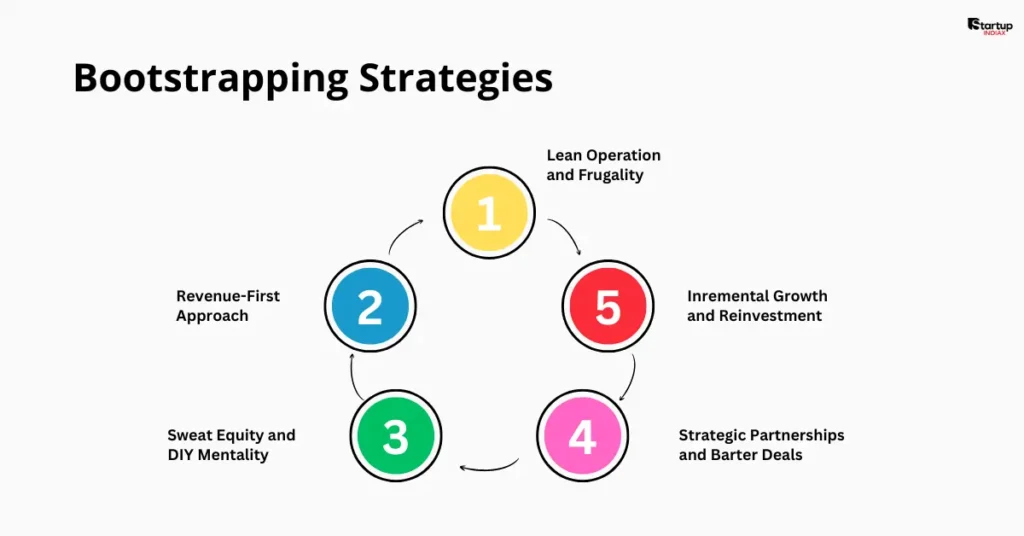

The Bootstrapping Method: Is Self-Funding a Viable Path for Your Startup?

Bootstrapping is the practice of funding your business with your own personal savings, and the revenue generated from the business itself. It is a popular choice for founders who want to retain full control and avoid external pressures.

- Pros: Complete ownership and decision-making power, no debt or equity dilution, and it forces a lean, disciplined approach to spending.

- Cons: Limited capital can hinder rapid growth, it puts personal finances at risk, and growth can be slower than competitors with external funding.

Example: Zoho Corporation, a leading Indian SaaS company, is a classic example of a successfully bootstrapped business. They grew organically, relying on their revenue to expand, proving that it’s possible to build a global powerhouse without a single rupee of venture capital.

Equity-Based Funding: How Do Angel Investors and VCs Shape Your Growth?

Equity funding involves selling a portion of your company’s ownership in exchange for capital. This is the most common path for startups with high growth potential.

- Angel Investors: These are high-net-worth individuals who invest their own money in early-stage startups. They often provide not just capital, but also invaluable mentorship and industry connections.

- Venture Capital (VC): VC firms are professional investors who manage funds from various sources and invest in startups with significant growth potential, typically in later stages.

Key Difference: Angel investors usually invest smaller amounts in the seed stage, while VCs provide larger amounts for Series A, B, and C rounds, often demanding a higher degree of control and a faster path to an exit.

Navigating Debt Financing: When Should You Consider a Loan or Venture Debt?

Debt financing involves borrowing money that must be repaid over time, with interest. Unlike equity, it does not require you to give up ownership.

- Pros: You retain full ownership of your company, interest payments are often tax-deductible, and debt can be secured quickly.

- Cons: The obligation to repay can be a significant burden on cash flow, and defaulting on a loan can lead to severe consequences for your business and personal credit.

A recent report by the Reserve Bank of India noted a significant increase in startup-focused debt products, showing a growing trend among non-banking financial companies (NBFCs) to cater to this segment.

Crowdfunding Explained: How Can a Community of Backers Fuel Your Idea?

Crowdfunding is the practice of raising small amounts of money from a large number of people, typically through online platforms.

- Types of Crowdfunding:

- Donation-based: Supporters donate without expecting a return.

- Reward-based: Backers receive a product or service in return for their contribution.

- Equity-based: Backers receive a small stake in the company.

Example: The Indian crowdfunding platform, Ketto, has helped numerous social enterprises and startups raise funds, demonstrating the power of community support.

Government Grants & Schemes: Are There Non-Dilutive Options for Your Business?

The Indian government has launched several initiatives to support startups. These grants are often non-dilutive, meaning you don’t have to give up equity in exchange for the funds.

Notable Schemes:

- Startup India Seed Fund Scheme: Provides financial assistance to startups for proof of concept, prototype development, and product trials.

- MeitY’s Startup Hub: Supports startups in the technology sector.

To learn more about how the government is helping startups, you can read our detailed article on top 8 government incubator programs transforming the Indian startup ecosystem. For those in the agriculture sector, we also recommend checking out top 10 government schemes boosting agritech and rural startups.

Beyond the Basics: Are There Any Hybrid or Non-Traditional Funding Models?

The startup ecosystem is constantly evolving. Beyond the traditional models, founders are exploring hybrid options like revenue-based financing (RBF), where investors get a percentage of the company’s revenue until a certain multiple is paid back. This model is gaining traction, particularly for SaaS and e-commerce startups.

Making the Right Choice: Which Funding Model Best Fits Your Business Stage?

Choosing the right funding model depends on several factors: your business stage, industry, growth potential, and personal risk tolerance.

- Early Stage (Ideation to Prototype): Bootstrapping, angel investors, and government grants are most common here. At this stage, you need to prove your concept without giving away too much equity.

- Growth Stage (Scaling Up): This is where you typically see Series A and B funding rounds from venture capital firms. The focus is on rapid market penetration and scaling operations.

- Maturity Stage: At this point, companies might consider debt financing to fund acquisitions or expansion, or even an Initial Public Offering (IPO).

A recent survey by Startup INDIAX found that over 60% of Indian founders consider understanding different funding models to be the most critical skill for long-term success.

What are the Key Takeaways for Securing Your Startup’s Future?

The path to a successful startup is paved with strategic decisions, and none is more critical than how you choose to finance your business. There is no one-size-fits-all solution; the best funding model for you is the one that aligns with your vision, values, and growth trajectory. Whether you choose to bootstrap, seek venture capital, or leverage a community through crowdfunding, the key is to be informed and strategic.

Don’t miss out on more insights and stories from the Indian startup ecosystem! Explore other articles on Startup INDIAX and subscribe to our newsletter for the latest trends, success stories, and expert advice. Share your own funding journey in the comments below we’d love to hear from you.

Frequently Asked Questions (FAQs)

What is the main difference between equity and debt funding?

The primary difference is ownership. Equity funding involves selling a portion of your company’s ownership to investors, while debt funding is a loan that must be repaid with interest, without giving up any ownership.

Is bootstrapping a good idea for every startup?

Bootstrapping is an excellent option for founders who want to retain full control and are able to generate revenue quickly. However, it may not be suitable for capital-intensive businesses or those aiming for rapid, global scale, as it can limit growth speed.

When should a startup approach a Venture Capital (VC) firm?

Startups typically approach VCs when they have a proven business model and are ready to scale rapidly. VCs look for startups with significant market potential, a strong management team, and a clear path to generating substantial returns on their investment.