Table of Contents

Summary:

- Lalit Keshre, a farmer’s son from Madhya Pradesh, became a billionaire worth ₹9,448 crore after Groww’s stock surged 70% in just 4 days following its historic IPO listing on BSE and NSE.

- From cracking JEE to graduating from IIT Bombay, working at Flipkart, and co-founding Groww, Keshre’s journey offers actionable lessons on solving real problems, staying user-focused, and building for India’s masses.

- This inspiring success story, covered exclusively by Startup INDIAX, showcases how grit, education, and the right timing can transform dreams into billion-dollar realities in India’s booming fintech sector.

When Groww’s stock jumped from ₹112 to ₹169 in just four days after its IPO, it wasn’t just numbers changing on a screen. It was the moment Lalit Keshre a farmer’s son from rural Madhya Pradesh officially became a billionaire.

His net worth? A staggering ₹9,448 crore.

But here’s what makes this story different from your typical startup success tale: Lalit didn’t come from money, connections, or privilege. He came from a small village where farming was the only career anyone knew. Yet today, he’s the co-founder and CEO of one of India’s most successful fintech platforms, with over 10 crore users trusting Groww for their investments.

So how did a kid from the farmlands crack IIT, work at Flipkart, and build a company that democratized investing for millions of Indians? What lessons can aspiring entrepreneurs take from his journey?

In this deep-dive, Startup INDIAX brings you the complete story of Lalit Keshre his struggles, his strategy, and the blueprint that turned Groww into a household name. Whether you’re a founder building your first startup or someone dreaming about entrepreneurship, this story has actionable gold for you.

Let’s get into it.

Who Is Lalit Keshre? The Man Behind Groww’s Success

Early Life: Growing Up in Madhya Pradesh’s Farmlands

Lalit Keshre was born and raised in a small village in Madhya Pradesh, where life revolved around agriculture. His father was a farmer, and like many rural families in India, education was seen as the only ticket out of poverty.

But Lalit wasn’t just academically inclined he was obsessed with learning. While most kids in his village had limited exposure to quality education, Lalit pushed himself relentlessly. He knew that cracking competitive exams like JEE was his shot at changing his family’s destiny.

And he did exactly that.

The IIT Bombay Dream and Reality

Lalit cleared the Joint Entrance Examination (JEE) and secured admission to IIT Bombay, one of India’s most prestigious engineering institutions. For a farmer’s son, this wasn’t just an achievement it was a transformation.

At IIT Bombay, Lalit studied hard, networked with brilliant minds, and started understanding how technology could solve massive problems. The exposure to peers who went on to build startups, work at top tech companies, and create impact shaped his entrepreneurial mindset.

But IIT was just the beginning. The real game started when he stepped into India’s startup ecosystem.

💡 Key Takeaway: Education can be the great equalizer. Lalit’s relentless focus on cracking JEE opened doors that seemed impossible from his village. Hard work + preparation = opportunity.

From IIT Bombay to Flipkart: Building the Foundation

Landing a Role at India’s Biggest Startup

After graduating from IIT Bombay, Lalit Keshre joined Flipkart India’s homegrown e-commerce giant that was revolutionizing online shopping in the country. This was around the time when Flipkart was scaling rapidly, competing with Amazon, and building products that millions of Indians used daily.

At Flipkart, Lalit worked in product management, where he gained deep insights into:

- Understanding user behavior at scale

- Building simple, intuitive interfaces for non-tech-savvy users

- The importance of trust in financial and consumer transactions

- How to scale a platform to serve millions

Key Learnings from the Flipkart Experience

Working at Flipkart wasn’t just a job for Lalit it was his MBA in building for India. Here’s what he learned:

Solve for Bharat, not just metro cities. Flipkart’s success came from making e-commerce accessible to tier 2 and tier 3 cities. Lalit saw firsthand how simplicity and localization could unlock massive markets.

Trust is everything. In India, where cash-on-delivery dominated, building trust was harder than building technology. This lesson would become central to Groww’s strategy later.

Timing matters. Lalit witnessed how Flipkart capitalized on smartphone penetration and cheaper internet. He understood that the right idea at the right time could create billion-dollar outcomes.

But after a few years at Flipkart, Lalit felt something was missing. He wanted to solve a problem that was personal, impactful, and underserved.

That’s when the idea of Groww was born.

The Birth of Groww: Democratizing Investment in India

Why Lalit Keshre Left Flipkart to Start Groww

In 2016, Lalit made a bold decision: he quit his stable, high-paying job at Flipkart to start something from scratch.

Why? Because he noticed a glaring problem in India’s investment landscape.

Despite having one of the world’s highest savings rates, most Indians didn’t invest. They kept money in bank savings accounts earning 3-4% interest while inflation ate away their purchasing power. Why?

- Investing seemed complicated and intimidating

- Brokerage platforms were designed for traders, not beginners

- High fees and confusing paperwork discouraged first-time investors

- Lack of financial literacy made people fear the stock market

Lalit believed technology could fix this. He envisioned a platform where anyone even a college student or a young professional could start investing in minutes, not days.

The Co-Founding Team: Building with the Right People

Lalit didn’t go solo. He teamed up with three brilliant co-founders, all ex-Flipkart colleagues:

- Harsh Jain (Co-founder & COO)

- Ishan Bansal (Co-founder)

- Neeraj Singh (Co-founder & CTO)

Together, they brought complementary skills: product, technology, operations, and growth. This wasn’t just a group of friends starting a company it was a mission-driven team with shared values and relentless execution ability.

Groww’s Mission: Making Investing Simple for Everyone

From day one, Groww’s mission was crystal clear: Make investing simple, transparent, and accessible for every Indian.

They started with mutual funds because:

- Lower risk compared to direct stocks

- Perfect for beginners

- Didn’t require active trading knowledge

- Could be started with as little as ₹100

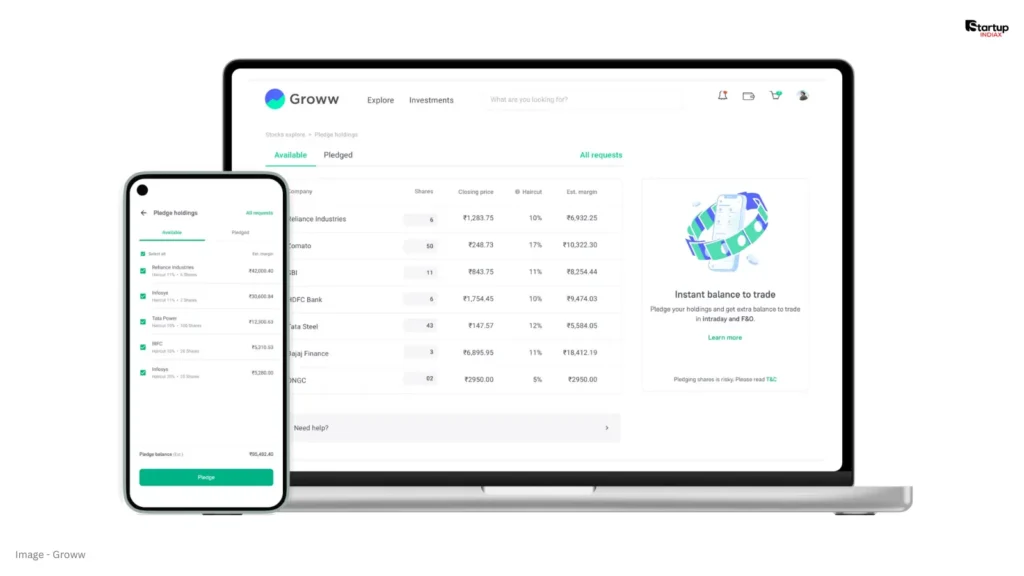

The Groww app was designed with obsessive attention to simplicity:

- Clean, clutter-free interface

- Zero jargon

- Step-by-step onboarding

- Educational content built into the app

- Completely paperless and digital

And the killer move? Zero commission on mutual funds. While traditional distributors charged hefty fees, Groww made it free. This single decision disrupted the entire industry.

💡 Key Takeaway: Groww succeeded because it solved a real problem with radical simplicity. Don’t just build features eliminate friction for your users.

How Groww Disrupted India’s Investment Landscape

The Problem Groww Solved

Before Groww, investing in India looked like this:

- Visit a broker’s office physically

- Fill out mountains of paperwork

- Pay high commissions and hidden fees

- Navigate confusing platforms built for experienced traders

- Wait days for account activation

Groww flipped the script entirely. Within 5 minutes, anyone with a smartphone could:

- Download the app

- Complete KYC digitally

- Start investing with ₹100

- Track their portfolio in real-time

This wasn’t incremental improvement it was 10x better than the status quo.

User-First Approach: Simplicity Over Complexity

While competitors focused on advanced charts, technical indicators, and features for day traders, Groww obsessed over first-time investors.

Every design decision asked: “Would my mom understand this?”

They added:

- Plain-language explanations of financial terms

- Recommended portfolios for different goals

- Bite-sized educational content

- Transparent fee breakdowns

- No hidden charges

According to Startup INDIAX research, Groww’s user retention rate in the early years was significantly higher than competitors because they removed anxiety from investing.

From Mutual Funds to Stocks: Expanding the Platform

After establishing dominance in mutual funds, Groww expanded to:

- Direct equity trading (buying and selling stocks)

- Digital Gold investments

- IPO applications

- US Stocks for Indian investors

- Fixed deposits and bonds

But here’s the smart part: they didn’t rush. Each product was launched only after ensuring the core experience remained simple and user-friendly.

By 2025, Groww had become a one-stop investment platform for over 10 crore users making it one of India’s most trusted fintech brands.

Read More: Physics Wallah Stock Listing: ₹145 Debut Sets YouTube-to-IPO Record

The Groww IPO: Historic Listing and Stock Surge

IPO Details: Listing on BSE and NSE

In early 2025, Groww went public with its Initial Public Offering (IPO), listing on both the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

The IPO was massively oversubscribed, signaling strong investor confidence in Groww’s business model and future growth potential.

Key IPO Metrics:

- Listing price: ₹112 per share

- Market capitalization at listing: ~₹60,000 crore

- Oversubscription: Multiple times the offered shares

- Investor sentiment: Overwhelmingly positive

Stock Performance: From ₹112 to ₹169 in 4 Days

What happened next was extraordinary.

Within just four trading days after listing, Groww’s stock price surged from ₹112 to ₹169 a jaw-dropping 70% increase.

Why did this happen?

- Strong debut performance triggered momentum buying

- Institutional investors increased their positions

- Retail investors showed massive confidence in fintech growth

- Positive analyst ratings and price target upgrades

- Growing user base and revenue projections

For Lalit Keshre and his co-founders, this wasn’t just about stock prices—it was validation that their mission to democratize investing had resonated with India.

Market Reception and Investor Confidence

The market’s response to Groww’s IPO revealed something crucial: investors believed in the fintech revolution and Groww’s leadership in it.

Analysts highlighted:

- Sticky user base with high engagement

- Strong revenue growth trajectory

- Expansion potential into wealth management

- Competitive moat built through brand trust

As featured on Startup INDIAX, Groww’s IPO success became a case study for how customer-first companies can win in competitive markets.

Lalit Keshre Net Worth: The Billionaire Milestone

Calculating the ₹9,448 Crore Fortune

With Groww’s stock hitting ₹169, Lalit Keshre’s net worth skyrocketed to approximately ₹9,448 crore (around $1.1 billion USD), officially making him a billionaire.

Here’s how the math worked:

Lalit holds a significant equity stake in Groww as co-founder and CEO. With the company’s post-IPO valuation exceeding ₹75,000 crore, even a stake of 12-15% translates to massive wealth.

Net worth breakdown:

- Groww equity stake value: ~₹9,400 crore

- Other investments and assets: ~₹48 crore

- Total estimated net worth: ₹9,448 crore

Stake in Groww and Equity Value

While exact stake percentages aren’t publicly disclosed, sources suggest Lalit Keshre and his co-founders collectively hold a substantial portion of the company, even after multiple funding rounds and IPO dilution.

What’s remarkable isn’t just the number it’s the journey behind it. From a village in Madhya Pradesh to becoming one of India’s youngest billionaire entrepreneurs, Lalit’s story represents the power of education, timing, and solving real problems.

💡 Key Takeaway: Wealth creation in startups comes from building valuable businesses, not chasing valuations. Lalit focused on solving India’s investment problem the billions followed.

Leadership Lessons from Lalit Keshre’s Journey

Lesson 1: Stay Rooted Despite Success

Even after becoming a billionaire, Lalit Keshre remains remarkably grounded. In interviews, he often credits his success to his upbringing and the values his farmer father instilled in him: hard work, humility, and resilience.

Actionable takeaway: Success changes your circumstances, not your character. Stay connected to your roots and the people who supported you.

Lesson 2: Solve Real Problems, Not Imaginary Ones

Groww didn’t start with “let’s build a trading app.” It started with “why don’t Indians invest?” This problem-first approach ensured product-market fit from day one.

Actionable takeaway: Before building anything, validate that the problem you’re solving is real, painful, and affects a large enough market.

Lesson 3: Build for India, Not Just Metro Cities

Groww’s interface is available in multiple Indian languages. The minimum investment is ₹100, not ₹10,000. The app works smoothly even on basic Android phones with slow internet.

These weren’t accidents they were deliberate design choices to serve Bharat, not just urban India.

Actionable takeaway: If you’re building for India, design for the constraints of the majority not the privileges of the minority.

Lesson 4: Team and Culture Matter More Than Ideas

Lalit often emphasizes that Groww’s success came from having the right co-founders and building a strong culture of ownership, transparency, and user obsession.

Actionable takeaway: Hire for values and attitude. Skills can be taught; integrity and drive cannot.

What Makes Groww Different from Competitors?

Zerodha vs Groww: The Battle for Retail Investors

India’s investment platform space has fierce competition primarily from Zerodha, the country’s largest stockbroker by active clients.

So how does Groww differentiate?

| Feature | Groww | Zerodha |

|---|---|---|

| Target Audience | First-time investors | Active traders |

| UI/UX | Extremely simple | Feature-rich but complex |

| Mutual Funds | Zero commission | Coin platform (separate) |

| Onboarding | 5 minutes, fully digital | Slightly longer process |

| Educational Content | Built into app | Varsity (separate platform) |

Groww positioned itself as the beginner-friendly platform, while Zerodha catered to more experienced traders who needed advanced tools.

Groww’s Competitive Edge

Trust and simplicity. In a market where financial fraud and complexity scare people away, Groww built a brand that felt safe, transparent, and easy.

Zero commission on mutual funds. This single move attracted millions of first-time investors who otherwise would’ve never started.

Content-driven growth. Groww invested heavily in financial literacy content, turning itself into an educator—not just a platform.

According to Startup INDIAX analysis, Groww’s genius was making investing feel less like finance and more like personal growth.

The Future: What’s Next for Lalit Keshre and Groww?

With the successful IPO behind them, what’s next for Lalit Keshre and Groww?

Potential expansion areas:

- Wealth management services for high-net-worth individuals

- Credit products (loans against securities, margin funding)

- International expansion (targeting NRI investors)

- Crypto and Web3 investments (if regulations allow)

- Financial advisory and planning tools powered by AI

Lalit has hinted in interviews that Groww’s mission remains unchanged: continue simplifying investing and expanding financial inclusion across India.

The IPO was just the beginning. With over 10 crore users and counting, Groww is positioned to become India’s de facto investment platform for the next generation.

And for Lalit Keshre? He’s proof that in India’s startup ecosystem, your background doesn’t determine your destiny your determination does.

Conclusion

Lalit Keshre’s journey from a farmer’s son in rural Madhya Pradesh to a billionaire entrepreneur worth ₹9,448 crore isn’t just inspirational it’s a masterclass in execution, timing, and unwavering focus on solving real problems.

He cracked IIT when education was his only way out. He learned product development at Flipkart when startups were booming. He identified a massive market gap in investing. And he built Groww with simplicity and trust as core principles.

The 70% stock surge after Groww’s IPO wasn’t luck it was the market rewarding years of user-focused innovation and building a business that truly matters to millions of Indians.

Key takeaways for aspiring entrepreneurs:

- Education and skill-building open doors that seem impossible

- Solve real, painful problems not imaginary ones

- Build for the masses, not just the privileged few

- Simplicity is a competitive advantage

- The right team and culture beat solo genius every time

Lalit Keshre’s story reminds us that Indian entrepreneurship isn’t just for the elite. It’s for anyone willing to work hard, think big, and execute relentlessly.

Want to start your own journey? Study success stories like Lalit’s, identify problems around you, and take that first scary step. Who knows your story might be the next one featured on Startup INDIAX.

What’s your biggest takeaway from Lalit Keshre’s journey? Share your thoughts in the comments below, and don’t forget to follow Startup INDIAX for more inspiring founder stories!

FAQs

What is Lalit Keshre’s current net worth in 2025?

Lalit Keshre’s net worth is approximately ₹9,448 crore ($1.1 billion USD) following Groww’s successful IPO and subsequent 70% stock surge. His wealth primarily comes from his equity stake in Groww, which is now valued at over ₹75,000 crore.

How did Lalit Keshre become a billionaire?

Lalit Keshre became a billionaire after co-founding Groww, India’s leading investment platform. When Groww’s stock surged from ₹112 to ₹169 within four days of its IPO listing, his equity stake skyrocketed in value, pushing his net worth past the billion-dollar mark.

What is Lalit Keshre’s educational background?

Lalit Keshre graduated from IIT Bombay after clearing the highly competitive Joint Entrance Examination (JEE). He grew up in rural Madhya Pradesh as the son of a farmer, making his IIT admission a significant achievement that changed his family’s trajectory.

What was Lalit Keshre’s role at Flipkart before starting Groww?

Before founding Groww, Lalit Keshre worked in product management at Flipkart, India’s largest e-commerce company. His experience there taught him how to build user-friendly products at scale, understand Indian consumer behavior, and develop platforms for non-tech-savvy users lessons he applied to Groww.

How many users does Groww have in 2025?

Groww has over 10 crore (100 million) registered users as of 2025, making it one of India’s largest investment platforms. The platform’s growth is attributed to its simple interface, zero-commission mutual fund investments, and focus on first-time investors.

What makes Groww different from other investment platforms like Zerodha?

Groww differentiates itself by targeting first-time investors with an extremely simple, beginner-friendly interface, zero commission on mutual funds, and educational content built into the app. While Zerodha caters to active traders with advanced tools, Groww focuses on making investing accessible to everyone—even those with zero financial knowledge.