Table of Contents

Summary

- Fund of funds for startups have committed ₹11,808 crores to 153 AIFs, catalyzing ₹22,942 crores invested in 1,270 Indian startups

- The 2x investment mandate requires AIFs to invest at least twice their FFS contribution directly in startups, multiplying impact

- Startups backed by fund of funds-supported VCs benefit from patient capital, larger follow-on rounds, and reduced exit pressure

Fund of funds for startups are reshaping how early-stage companies access capital in 2025. Unlike traditional venture capital, these investment vehicles pool money to back multiple VC firms, creating a ripple effect across the ecosystem. India’s government-backed Fund of Funds for Startups has committed ₹11,808 crores to 153 alternative investment funds since its launch in 2016, helping 1,270 startups raise ₹22,942 crores. But what exactly are fund of funds, and why should every founder understand this model? Here’s everything you need to know about this game-changing funding mechanism.

What Are Fund of Funds for Startups?

Fund of funds for startups operate differently from direct venture capital. Instead of investing directly in companies, they invest in other VC funds that then support startups. Think of it as a multiplier effect for the entire ecosystem.

A fund of funds manager identifies promising VC firms, commits capital to their funds, and gains exposure to their entire portfolio. This means one strategic investment decision can impact 20-30 startups instead of just one company.

The model gained massive traction in India after Prime Minister Narendra Modi launched the Fund of Funds for Startups on January 16, 2016. Managed by SIDBI, this initiative has an approved corpus of ₹10,000 crore, with ₹11,808 crores already committed to SEBI-registered Alternative Investment Funds as of March 2025.

Read More: Startup India Seed Fund: Eligibility & How to Apply

How the Fund of Funds Model Works for Startups

Understanding the mechanics matters for founders evaluating their VC’s backing. Fund of funds for startups follow a specific investment mandate that directly impacts your fundraising journey.

Under the FFS scheme, any AIF receiving government backing must invest at least twice the FFS contribution amount in startups. If your VC gets ₹100 crore from FFS, they must deploy minimum ₹200 crore into startups like yours.

This 2x mandate ensures that government funds catalyze significantly larger private capital flows. The numbers prove it works. AIFs backed by FFS have collectively invested ₹22,942 crores across 1,270 Indian startups, creating over 2 lakh jobs.

Only funds with corpus sizes below ₹1,000 crores qualify for FFS backing. This deliberately targets smaller, emerging fund managers who struggle to raise institutional capital otherwise.

Read More: Startup India Scheme Explained – How to Apply & Get Funding

Types of Fund of Funds Supporting Indian Startups

Not all fund of funds operate identically. Understanding different FFS variants helps founders identify which capital sources align with their business stage and geography.

The main Fund of Funds for Startups operates nationally, but SIDBI manages four other specialized fund of funds programs. The ASPIRE Fund targets rural innovation and entrepreneurship. State-specific funds like UP Startup Fund and Odisha Startup Growth Fund focus on regional ecosystem development.

The India Aspiration Fund specifically backs social impact ventures and enterprises in underpenetrated sectors. Together, these programs ensure fund of funds capital reaches diverse founder demographics and business models.

As of 2025, 82 of the 153 backed AIFs are first-time fund managers. This democratization of VC funding creates opportunities for founders in Tier 2 and Tier 3 cities who previously lacked access to institutional capital.

Read More: Top 8 Government Incubator Programs Transforming the Indian Startup Ecosystem

The Real Cost: Understanding Fee Structures

Every founder should understand the economics behind fund of funds for startups. The fee structure impacts your cap table and dilution more than you might realize.

Fund of funds typically charge a management fee of 1-2% annually, plus a performance fee of 10-20% on profits. Since the underlying VC funds also charge their own fees, you’re essentially paying fees at two levels.

A successful startup in this model pays roughly 4-5% in combined management fees across the investment chain. While this sounds steep, the tradeoff is access to patient capital with longer investment horizons.

Data from industry reports shows that fund of funds delivered a median IRR of 18% between 2018-2023, comparable to direct VC investments. The diversification benefits justify the additional fee layer for most institutional investors.

Benefits of Fund of Funds Backing for Your Startup

If your VC receives fund of funds support, you gain several indirect advantages that improve your odds of success and scaling.

First, you get patient capital. Traditional VCs need exits within 5-7 years, but fund of funds investors operate on 10-12 year horizons. This reduces pressure to chase unsustainable growth or force premature exits.

Second, your VC likely has stronger reserves for follow-on rounds. Under the 2x mandate, AIFs must maintain substantial dry powder for existing portfolio companies. According to Startup INDIAX analysis, startups backed by FFS-supported VCs raised 28% larger Series B rounds on average in 2024.

Third, you benefit from ecosystem credibility. When SIDBI backs your VC after rigorous due diligence, it signals quality to other investors. This makes subsequent fundraising rounds easier and faster.

Read More: Startup India Certificate – How to Apply in 5 Easy Steps

The Impact: Real Numbers from the Ground

The fund of funds model has created measurable impact across India’s startup ecosystem over the past nine years. The numbers tell a compelling story about inclusive growth.

₹3,547 crores has flowed to 184 women-led or women co-founded startups through FFS-backed AIFs. This represents significant progress in addressing gender gaps in venture funding.

Deep-tech startups received ₹3,533 crores across 220 companies, proving that fund of funds capital supports innovation beyond consumer apps. Tier 2 and Tier 3 city startups attracted ₹2,145 crores across 185 companies, breaking the traditional metro-city concentration of VC funding.

Perhaps most impressively, 22 startups backed by FFS-supported AIFs have achieved unicorn status, crossing the $1 billion valuation mark. These include names across sectors from fintech to logistics to SaaS.

Netizens React: What the Startup Community Says

The funding model has sparked diverse opinions across founder communities and social media platforms.

One founder wrote, “Fund of funds backing gave our VC the confidence to write us a bigger check. It indirectly helped us raise our Series A faster than peer companies.”

A skeptical investor commented, “Double fees are a real concern. Founders should understand they’re essentially paying 4-5% in total management fees across the chain. That adds up over time.“

An ecosystem builder from Jaipur noted, “This model is perfect for Tier 2 and Tier 3 city startups. It’s bringing institutional capital to regions VCs traditionally ignored completely.“

How to Know If Your VC Has Fund of Funds Backing

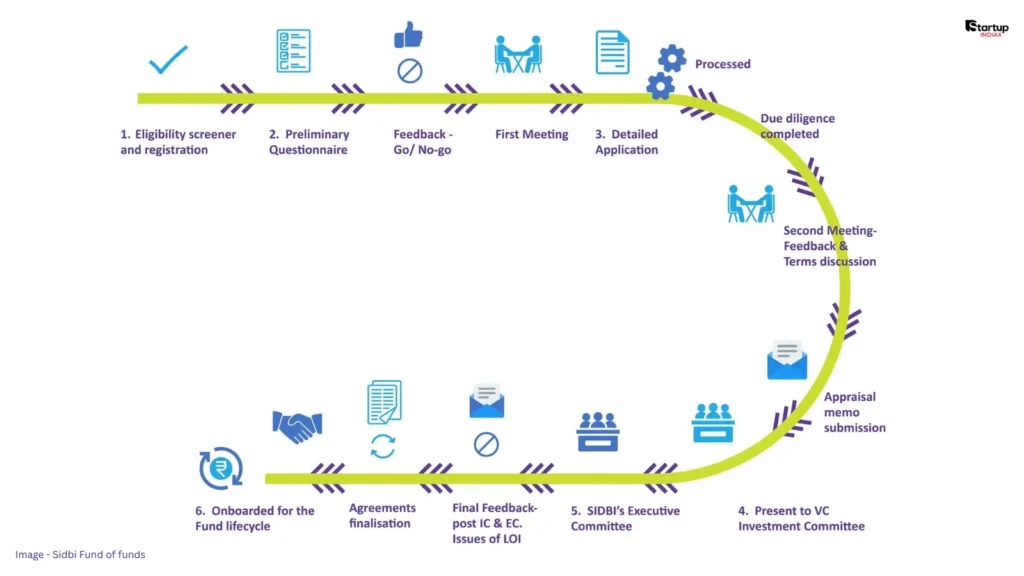

Founders don’t pitch directly to fund of funds but understanding if your potential VC partner has this backing provides valuable insights.

Check SIDBI’s public commitments page, which lists all 153 AIFs that have received FFS backing. The list includes fund names, commitment amounts, and commitment dates.

During due diligence calls, directly ask VCs about their LP structure. Any reputable fund will transparently share if they’ve received government backing through FFS or other programs.

Look for VCs with longer fund life cycles. Fund of funds-backed AIFs typically structure 10+ year funds versus the standard 7-8 year funds. This signals alignment with sustainable growth timelines.

What This Means for You

Is your startup backed by a VC that receives fund of funds investment? Understanding your capital structure matters more than ever in 2025. Check if your VC appears on SIDBI’s commitments list and share your experiences in the comments below. Explore more insights on funding strategies and ecosystem developments at Startup INDIAX!

Read More: How to Secure Your Startup’s Future: Understanding Different Funding Models

FAQs

What is fund of funds for startups?

Fund of funds for startups are investment vehicles that invest in multiple venture capital funds rather than directly in companies. India’s FFS has backed 153 AIFs that collectively support 1,270 startups with ₹22,942 crores.

How does SIDBI’s Fund of Funds for Startups work?

SIDBI’s FFS invests in SEBI-registered AIFs with a 2x mandate, meaning AIFs must invest at least twice the FFS contribution in startups. This multiplier effect catalyzes larger private capital deployment across the ecosystem.

What are the eligibility criteria for funds applying to FFS?

Funds must be SEBI-registered Category I or II AIFs with corpus below ₹1,000 crores, have experienced fund managers with CIBIL scores above 650, and commit to investing at least 2x the FFS contribution in eligible startups.

What are the fees for fund of funds investments?

Fund of funds typically charge 1-2% annual management fees plus 10-20% performance fees, creating a double-layer structure since underlying VC funds also charge fees. Combined fees typically total 4-5% for portfolio companies.

How has Fund of Funds impacted Indian startups?

FFS has created 2 lakh+ jobs, supported 22 unicorns, invested ₹3,547 crores in women-led startups, deployed ₹3,533 crores in deep-tech companies, and channeled ₹2,145 crores to Tier 2/3 city startups.