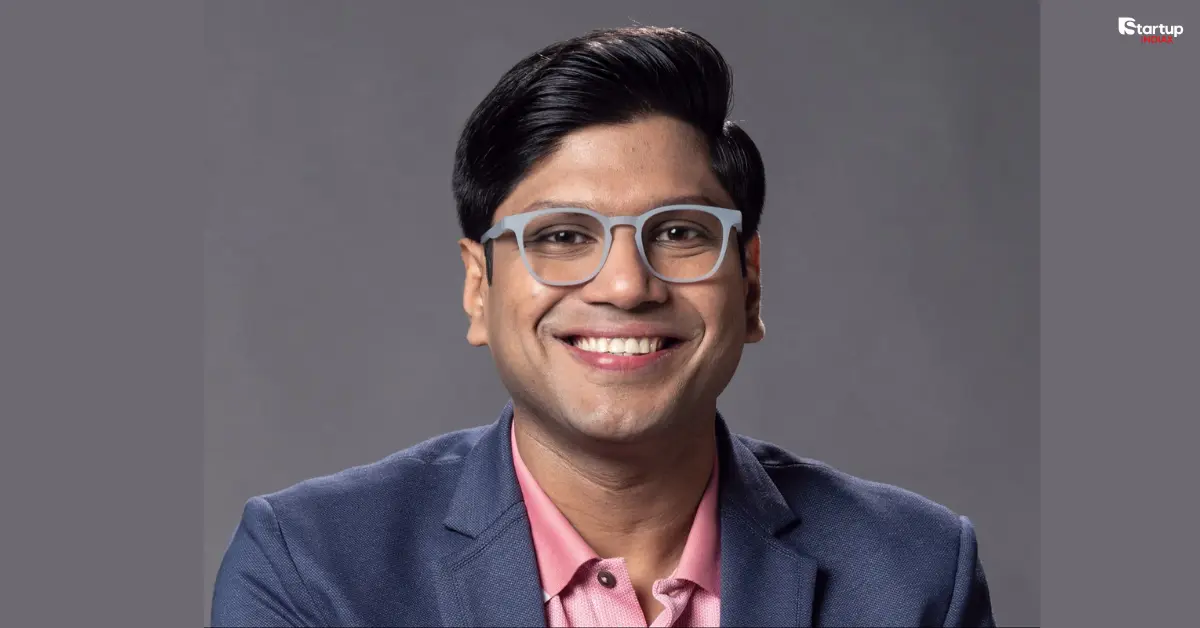

Lenskart DRHP filing marks a defining moment for India’s eyewear unicorn, with CEO Peyush Bansal’s INR 221.1 Cr share purchase stealing the spotlight. This bold move, detailed in the Draft Red Herring Prospectus (DRHP) filed with SEBI, underscores Bansal’s confidence in Lenskart’s $10 billion valuation target. In this Startup INDIAX exclusive, we dive into why Bansal increased his stake, how Lenskart plans to leverage its IPO, and what this means for India’s startup ecosystem. Entrepreneurs and digital professionals will find actionable insights on scaling, strategic investments, and navigating the IPO journey with transparency.

Table of Contents

What Is Lenskart’s DRHP and Why Is It Significant?

Lenskart, founded in 2010 by Peyush Bansal, Amit Chaudhary, and Sumeet Kapahi, has disrupted India’s eyewear market with its omnichannel model, combining e-commerce with over 2,700 stores worldwide. The Lenskart DRHP, filed with SEBI on July 29, 2025, signals the company’s intent to launch a blockbuster IPO, targeting a valuation of INR 70,000–75,000 Cr ($8–9 billion). This filing is a game-changer, positioning Lenskart among India’s top consumer tech IPOs, alongside giants like Zomato and Nykaa.

The DRHP offers a transparent look into Lenskart’s financials, growth trajectory, and risks, making it a critical document for investors and entrepreneurs. Unlike many startups opting for confidential filings, Lenskart’s public DRHP reflects confidence in its fundamentals and aims to build trust with domestic and global investors.

How Does the DRHP Set the Stage for Lenskart’s IPO?

The Lenskart DRHP outlines a public issue comprising a fresh issue of INR 2,150 Cr and an offer-for-sale (OFS) of 132.3 million shares, potentially raising INR 7,500–8,000 Cr. With a 33% revenue CAGR from FY23 to FY25 (reaching INR 6,625 Cr), Lenskart’s growth is fueled by its tech-driven approach, including AI-powered virtual try-ons and a vertically integrated supply chain. The DRHP also highlights its global footprint, with 656 international stores and recent acquisitions like Spain-based Stellio for INR 400 Cr.

Why Did Peyush Bansal Invest INR 221 Cr in Shares?

In a strategic move, Peyush Bansal acquired 42.7 million shares for INR 221.1 Cr from investors like SoftBank, Kedaara Capital, Chiratae Ventures, and Temasek between July 16 and July 24, 2025, at INR 52 per share. This purchase, executed at a $1 billion valuation—90% lower than the IPO target of $10 billion—increased his stake by 2.5% to 10.3% (17.3 Cr shares).

Why such a bold move? Bansal’s investment signals unwavering belief in Lenskart’s future. By buying at a steep discount, he maximizes potential returns at the IPO’s higher valuation. This mirrors strategies by founders of Zomato and Swiggy, who bolstered stakes pre-IPO to retain influence and capitalize on growth.

What Does This Mean for His Stake in Lenskart?

Bansal’s 10.3% stake is significant, but he’s also selling 20.5 million shares in the IPO’s OFS, potentially earning INR 700–750 Cr at the targeted valuation. Other founders—Neha Bansal (5.7 million shares), Amit Chaudhary, and Sumeet Kapahi (2.87 million each)—are also offloading shares, with promoters collectively holding a 20% stake. This dual approach of buying low and selling high showcases Bansal’s financial acumen while maintaining a strong leadership presence.

How Is Lenskart Preparing for Its Public Listing?

Lenskart’s IPO preparations are robust, reflecting its ambition to dominate the global eyewear market. In June 2024, the company raised $200 million from Temasek and Fidelity at a $5 billion valuation, enabling early investors like SoftBank to exit partially. Lenskart also converted to a public limited company and secured shareholder approval for the INR 2,150 Cr fresh issue. Top investment banks, including Kotak Mahindra Capital, Morgan Stanley, and Avendus, are managing the IPO, ensuring regulatory compliance and investor appeal.

What Are the Key Details of the DRHP Filing?

The Lenskart DRHP details:

- Fresh Issue: INR 2,150 Cr for expansion and tech investments.

- Offer-for-Sale: 132.3 million shares from founders and investors like SoftBank (25.5 million shares), Premji Invest (8.7 million), and Kedaara Capital (7.36 million).

- Valuation Goal: INR 70,000–75,000 Cr ($8–9 billion).

- Pre-IPO Placement: Potential INR 430 Cr placement, which may reduce the fresh issue size.

Lenskart’s transparent filing, unlike the confidential route chosen by some startups, underscores its confidence in its financial health and market position.

How Will Lenskart Utilize the IPO Proceeds?

The INR 2,150 Cr fresh issue will fund:

- INR 272.6 Cr: 620 new company-owned stores in India by FY29.

- INR 591.4 Cr: Lease and rental expenses for existing stores.

- INR 213.4 Cr: AI and robotic lens lab investments.

- INR 320 Cr: Brand marketing and business promotion.

These investments aim to strengthen Lenskart’s omnichannel presence, enhance technology, and boost brand visibility, positioning it to compete with global players like Warby Parker and Luxottica.

What Challenges Could Impact Lenskart’s IPO Success?

Despite its growth, Lenskart faces challenges. In FY24, it reported a INR 10 Cr loss on INR 5,427 Cr revenue, reflecting high costs from global expansion. Scaling internationally while achieving profitability remains a hurdle, especially in competitive markets like Japan and the UAE.

Are Franchisee Disputes a Threat to Lenskart?

Lenskart’s franchisee model, powering 2,067 India-based stores, has sparked concerns. In October 2024, Karnataka franchisees filed an FIR alleging financial discrepancies, though Lenskart secured a stay order from the Karnataka High Court in January 2025. Expert Opinion: “Franchisee conflicts can erode investor trust, particularly for retail-heavy businesses,” says Priya Sharma, a retail analyst at Startup INDIAX. “Lenskart must address these transparently to ensure a smooth IPO.”

Supply chain concentration and debt risks, as noted in the DRHP, could also impact scalability if not managed effectively.

What Can Entrepreneurs Learn from Lenskart’s DRHP Strategy?

Lenskart’s journey offers key takeaways for startup founders:

- Transparency Builds Trust: The public Lenskart DRHP filing showcases confidence, encouraging entrepreneurs to embrace openness with stakeholders.

- Strategic Stake Building: Bansal’s INR 221 Cr purchase at a discount highlights the value of increasing founder ownership pre-IPO.

- Tech as a Differentiator: Lenskart’s AI tools and vertical integration demonstrate how technology can disrupt traditional industries.

Conclusion: Join the Lenskart DRHP Conversation

Peyush Bansal’s INR 221 Cr share buy and Lenskart’s bold DRHP filing signal a new era for India’s eyewear giant. As Lenskart prepares for its $10 billion IPO, it’s a story of vision, strategy, and resilience. What do you think of Bansal’s move and Lenskart’s IPO plans? Drop your thoughts in the comments, share this story, or explore more startup insights on Startup INDIAX to stay ahead in India’s dynamic tech landscape!