Introduction: The Buzz Around New-Age Tech Stocks

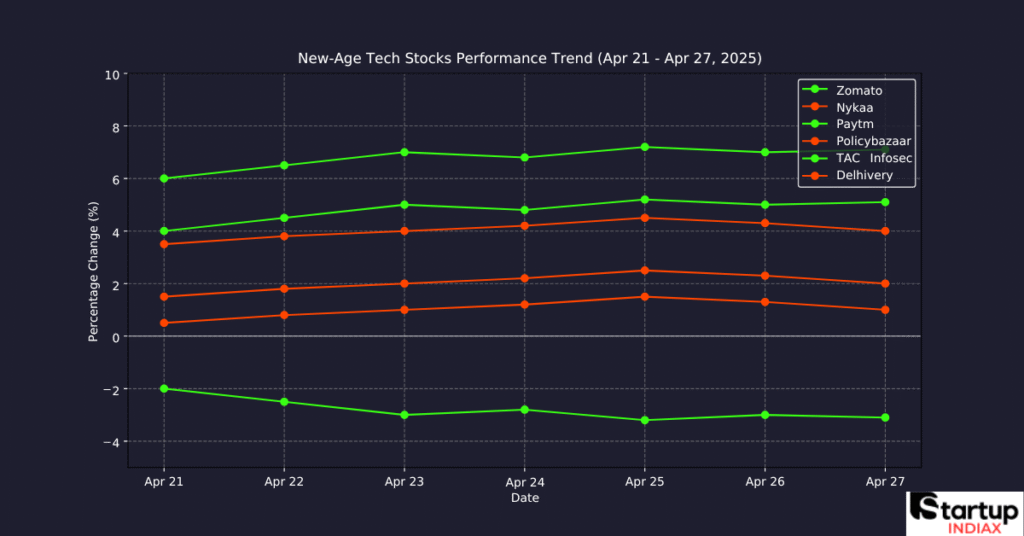

Hey there, investor! If you’ve been keeping an eye on the Indian stock market, you’ve probably noticed the buzz around new-age tech stocks. These companies think Zomato, Paytm, and Delhivery are shaking things up with their innovative business models and tech-driven solutions. In 2025, they’re making headlines again, thanks to the NSE rejigged criteria for mainboard listings. This change has sparked a rally, with some stocks surging by over 8% in a single week! In this article, we’ll explore why these stocks are soaring, spotlight the top five gainers, and share tips for navigating this exciting sector. Let’s dive in

What’s Behind the NSE Rejigged Criteria?

The National Stock Exchange (NSE) recently shook things up by tweaking the rules for companies moving from the SME platform (NSE Emerge) to the mainboard. The NSE rejigged criteria, announced on April 24, 2025, set stricter benchmarks: companies need an operating revenue of over INR 100 Cr in the previous fiscal year and must be profitable for at least two of the last three years. This move aims to ensure only financially robust companies make it to the big league, boosting investor confidence.

Why does this matter for new-age tech stocks? Many of these companies, like Delhivery and Paytm, are already mainboard players or meet these criteria, signaling stability and growth potential. The rejig has also weeded out weaker players, making the sector more attractive to investors. However, some SMEs, like TAC Infosec, faced selling pressure as they fell short of the new rules, highlighting the mixed impact of the NSE rejigged framework.

Top 5 New-Age Tech Stock Gainers in 2025

Let’s get to the exciting part—the top performers! Here are the five new-age tech stocks that have been stealing the show in 2025, post-NSE rejig.

Delhivery: The Logistics Leader

Delhivery, the logistics giant, is the star of the show, with its shares soaring 8.45% in a week to close at INR 304.70. The NSE rejigged criteria have reinforced investor trust in Delhivery’s robust financials and scalable model. With India’s e-commerce boom, Delhivery’s end-to-end supply chain solutions are in high demand. Its focus on tech-driven logistics and last-mile delivery has made it a favorite among investors.

Paytm: Fintech’s Comeback King

Paytm’s stock rallied 3.17% to INR 875.85, marking a strong comeback. After facing regulatory hurdles, Paytm has bounced back with improved fundamentals and a diversified fintech portfolio. The NSE rejigged rules have spotlighted Paytm’s profitability, making it a top pick for investors betting on digital payments and financial services.

Zomato: Foodtech’s Steady Climb

Zomato, the foodtech pioneer, gained 2.20% in a week, trading at a healthy premium. Despite legal notices over app accessibility, Zomato’s strong market position and expansion into quick commerce (Blinkit) have kept investors optimistic. The NSE rejigged criteria align with Zomato’s consistent revenue growth, cementing its spot among new-age tech stocks.

Policybazaar: Insurtech’s Rising Star

PB Fintech (Policybazaar) climbed 8% in a week, emerging as a standout in the insurtech space. The NSE rejigged framework favors companies with strong financials, and Policybazaar’s profitable model fits the bill. Its user-friendly platform and growing insurance penetration in India make it a stock to watch.

Swiggy: Quick Commerce on the Move

Swiggy ended the week at INR 321.35, despite a 5.75% dip due to legal challenges over app accessibility. However, its quick commerce arm, Instamart, and the NSE rejigged boost for mainboard-listed firms keep Swiggy in the spotlight. Investors are betting on its long-term growth in India’s hyper-competitive foodtech market.

Why Are New-Age Tech Stocks Rallying?

So, what’s driving this surge in new-age tech stocks? Let’s break it down:

- NSE Rejigged Confidence Boost: The stricter mainboard criteria have filtered out weaker players, making new-age tech stocks like Delhivery and Paytm more appealing. Investors see these companies as safer bets with strong fundamentals.

- E-commerce and Digital Boom: India’s digital economy is exploding, with e-commerce, fintech, and quick commerce leading the charge. Companies like Zomato and Swiggy are capitalizing on this trend, driving stock gains.

- Improved Financials: Many new-age tech stocks have turned profitable or are on the verge of it. For instance, Delhivery’s operational efficiency and Paytm’s diversified revenue streams signal long-term growth.

- Global Investor Sentiment: Positive cues from global markets, like easing tariff wars, have uplifted sentiment in India, benefiting new-age tech stocks. However, geopolitical tensions, like India-Pakistan relations, add volatility.

- Innovation Edge: These companies leverage cutting-edge tech—AI, machine learning, and data analytics—to stay ahead. This innovation resonates with investors looking for the next big thing.

Challenges for New-Age Tech Stocks Post-NSE Rejig

It’s not all smooth sailing. Despite the rally, new-age tech stocks face hurdles:

- Regulatory Scrutiny: Companies like Swiggy and Zomato have faced legal notices over app accessibility, which could dent investor confidence.

- High Volatility: The Indian market saw swings in 2025 due to geopolitical tensions and commodity price hikes, impacting new-age tech stocks.

- SME Struggles: The NSE rejigged criteria have hit smaller players like TAC Infosec hard, with shares plunging 14.89%. This shows the risk of investing in less-established tech firms.

- Competition: The tech sector is cutthroat, with players like Swiggy and Zomato battling for market share in quick commerce and foodtech.

- Valuation Concerns: Some investors worry that new-age tech stocks are overvalued, especially after rapid gains. A market correction could pose risks.

Investor Tips: Should You Bet on New-Age Tech Stocks?

Thinking of jumping into new-age tech stocks? Here are some tips to guide you:

- Do Your Homework: Research the company’s financials, market position, and growth potential. Stocks like Delhivery and Paytm have strong fundamentals, but always dig deeper.

- Diversify: Don’t put all your eggs in one basket. Mix new-age tech stocks with stable blue-chip stocks to balance risk.

- Watch Volatility: The NSE rejigged market is exciting but volatile. Keep an eye on global and domestic cues, like geopolitical tensions or commodity prices.

- Long-Term View: New-age tech stocks are growth stories. If you believe in India’s digital economy, hold for the long haul despite short-term dips.

- Consult Experts: Unsure where to start? A financial advisor can help you navigate the NSE rejigged landscape and pick the right stocks.

Conclusion: The Future of New-Age Tech Stocks

The NSE rejigged criteria have lit a fire under new-age tech stocks in 2025, with companies like Delhivery, Paytm, and Zomato leading the charge. While challenges like regulatory hurdles and market volatility persist, the sector’s growth potential is undeniable. India’s digital economy is on a tear, and these stocks are at the forefront. Whether you’re a seasoned investor or a newbie, now’s the time to explore this dynamic market—just tread carefully and stay informed. What’s your take on new-age tech stocks? Drop a comment below