Summary

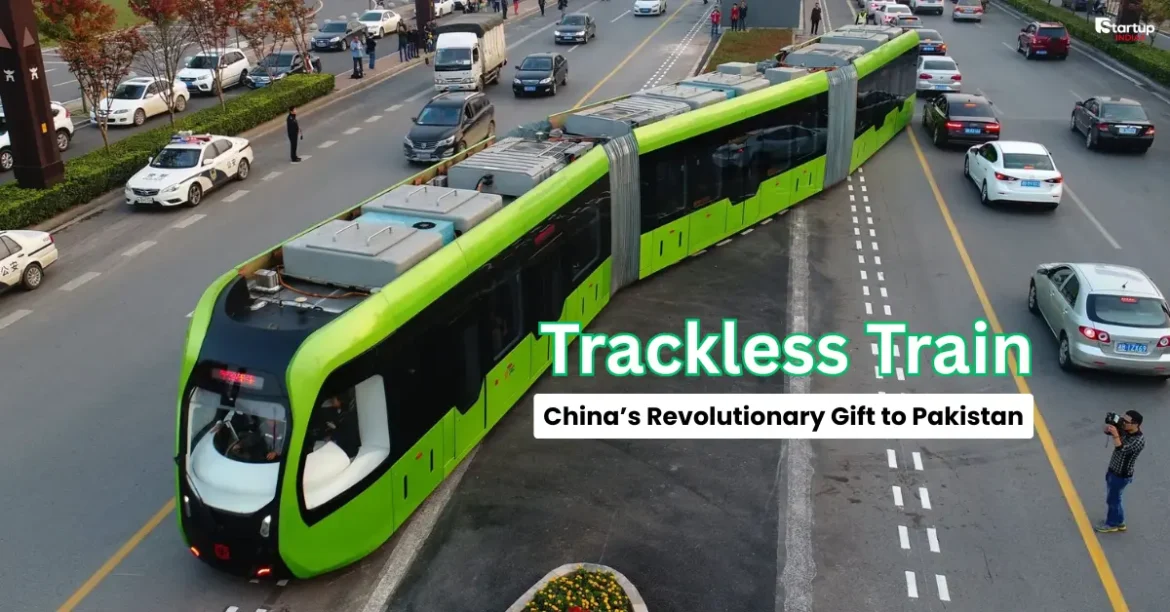

- Trackless Train: China’s cutting-edge transport gift to Pakistan promises to revolutionize urban mobility with its road-based, rail-free design.

- Discover how this trackless system reduces infrastructure costs, eases traffic, and could set a precedent for future smart cities.

- Startup INDIAX brings you exclusive insights into why this innovation matters for entrepreneurs and urban planners alike.

Table of Contents

Introduction: What Is the Trackless Train?

Imagine a train that glides smoothly on roads—no tracks, no heavy infrastructure, just cutting-edge technology. China’s latest gift to Pakistan, the trackless train, is turning this vision into reality. Designed to tackle urban congestion and reduce reliance on traditional railways, this innovation could redefine public transport in Pakistan and beyond.

At Startup INDIAX, we explore how this road-running train combines the efficiency of rail with the flexibility of buses—and why it’s a game-changer for smart cities.

How Does the Trackless Train Work?

Unlike conventional trains, the trackless train operates on virtual tracks using advanced sensors and autonomous driving technology. Here’s the breakdown:

- Virtual Rails: Painted lines or embedded sensors guide the train, eliminating the need for physical tracks.

- Hybrid Power: Electric batteries or hydrogen fuel cells ensure zero emissions, aligning with global sustainability goals.

- Top Speed & Capacity: With speeds up to 70 km/h and a capacity of 300+ passengers, it rivals metro systems at a fraction of the cost.

Expert Insight:

“This system merges the best of buses and metros—flexibility without sacrificing efficiency.”

— Dr. Li Wei, Transport Engineer at China Railway Group.

Why Is This a Game-Changer for Pakistan?

Pakistan’s cities, like Karachi and Lahore, face crippling traffic jams. The trackless train offers:

- Cost Savings: No expensive rail infrastructure—just modified roads.

- Rapid Deployment: Cities can implement it in months, not years.

- Scalability: Expand routes easily as demand grows.

Real-Life Example:

The city of Zhuzhou, China, reduced traffic congestion by 30% after deploying a similar system in 2020.

Trackless Train vs. Traditional Railways: Key Differences

Table

| Feature | Trackless Train | Traditional Railways |

|---|---|---|

| Infrastructure | Minimal (roads only) | Extensive (tracks, stations) |

| Flexibility | Adjustable routes | Fixed routes |

| Cost | $10M/km (approx.) | $50M+/km (approx.) |

Verdict: The trackless system wins for adaptability and affordability.

Challenges and Potential Drawbacks

- Public Skepticism: Will commuters trust a “train on wheels”?

- Maintenance: Road wear and tear could increase long-term costs.

- Regulatory Hurdles: New policies needed for road-sharing with other vehicles.

Expert Opinions: What Industry Leaders Say

- “This is the future of mid-capacity transit.” — Global Transport Forum.

- “Pakistan could leapfrog decades of transport delays with this tech.” — Urban Planner, Lahore Development Authority.

The Bigger Picture: China’s Role in Global Transport Innovation

This project aligns with China’s Belt and Road Initiative (BRI), showcasing its ability to export scalable infrastructure solutions. For Pakistan, it’s a chance to modernize while strengthening ties with a key ally.

Conclusion: What’s Next for Pakistan’s Transport Future?

The trackless train isn’t just a novelty—it’s a blueprint for affordable, sustainable urban mobility. As Pakistan tests this system, the world will be watching.

What do you think? Share your thoughts in the comments or explore more Startup INDIAX stories on tech-driven solutions!

FAQ

Q: How is the trackless train powered?

A: It uses electric batteries or hydrogen fuel cells for zero emissions.

Q: Will it replace buses and metros?

A: Unlikely—it’s designed to complement existing systems for mid-capacity routes.

Q: What’s the estimated cost for Pakistan?

A: Around $200–300 million for a pilot city deployment.