Summary

- Physics Wallah IPO listed at ₹145 with a 33% premium over issue price.

- Marks India’s first creator-led, YouTube-to-IPO edtech journey.

- IPO funds target hybrid expansion, tech upgrades, and brand-building.

Physics Wallah IPO stuns Dalal Street as India’s first YouTube-to-IPO edtech company, launching shares at ₹145 33% above the offer price. With a ₹3,480 crore issue and a roaring debut in November 2025, the story is setting benchmarks for digital-first education startups. How did a humble YouTube channel transform into a $3.6 billion disruptor? Let’s decode what this historic IPO means for India’s creator economy and the future of edtech.

How Did Physics Wallah Go from YouTube Channel to Dalal Street Sensation?

Physics Wallah began in 2016 with just ₹30,000, humble physics lessons by founder Alakh Pandey, and a mission to make quality learning accessible. Fast-forward to 2025: Physics Wallah commands a market cap exceeding ₹40,000 crore (roughly $4.9 billion), with 28.45 crore fresh shares and 3.49 crore shares offered by selling shareholders.

Hyped as the first homegrown YouTube creator-led startup to IPO, Physics Wallah is shaking up a sector once thought to be dominated by big capital and legacy brands. Investors showed strong faith too the IPO was subscribed nearly twice over, with anchor investors pouring in ₹1,562 crore.

Read More: PhonePe IPO Breakthrough: SEBI Filing Unveils Massive $12B Dreams

Why Is the Physics Wallah IPO a Game-Changer for Indian Startups?

The company’s success marks the next phase for India’s edtech scene, positioning digital educators alongside traditional giants on Dalal Street. Experts noted how few Indian edtech companies have survived let alone thrived with IPO dreams in recent years. PW’s market entry, against a background of sector slowdowns and job cuts among peers, signals resilience and renewed investor trust.

Founders Alakh Pandey and Prateek Maheshwari kept their focus razor-sharp: high-quality, affordable learning for competitive exams, plus aggressive expansion in both online and offline learning hubs. The IPO proceeds, say insiders, are earmarked for new hybrid centers, tech upgrades, and brand-building.

Read More: OpenAI AICTE Partnership: 150K Free ChatGPT Go for Students

What Does This Mean for the Edtech Sector and Creator Economy?

For the broader edtech industry, Physics Wallah’s debut is a hopeful sign. Despite concerns around profitability, the listing premium stands out, especially as other edtech players grapple with funding crunches and contraction. The blending of creator authenticity with scalable business models could inspire a new wave of teacher-preneurs.

Industry experts also highlight valuation challenges, as PhysicsWallah’s IPO was valued at an EV/sales multiple of 10.7x still, strong topline growth offers optimism for long-term profitability.

Read More: Intuit OpenAI Deal: $100M+ Partnership Brings TurboTax, QuickBooks Coming to ChatGPT

Netizens React

The community emerged with mixed, lively reactions:

One user wrote, “Never thought a YouTuber would ring the Dalal Street bell. Kudos to Alakh Pandey – absolute inspiration!“

Another commented, “Hope Physics Wallah keeps quality high and doesn’t go the BYJU’S way.“

A skeptic questioned, “33% pop is wild, but will the company deliver profits year after year?“

What do you think about Physics Wallah’s record-breaking IPO? Share your thoughts in the comments, and don’t miss more breakthrough stories from India’s startup universe on Startup INDIAX!

FAQs

What is the Physics Wallah IPO?

Physics Wallah’s IPO is India’s first edtech public offering from a YouTube-origin company, priced at ₹109 and listed at ₹145, signaling strong investor demand.

Who founded Physics Wallah?

Physics Wallah was founded by Alakh Pandey and Prateek Maheshwari in 2016, starting as a YouTube channel.

Why is Physics Wallah’s IPO historic?

It marks the first time a grassroots Indian YouTube creator has launched a successful IPO, paving the way for digital-first Indian startups.

How will IPO funds be used?

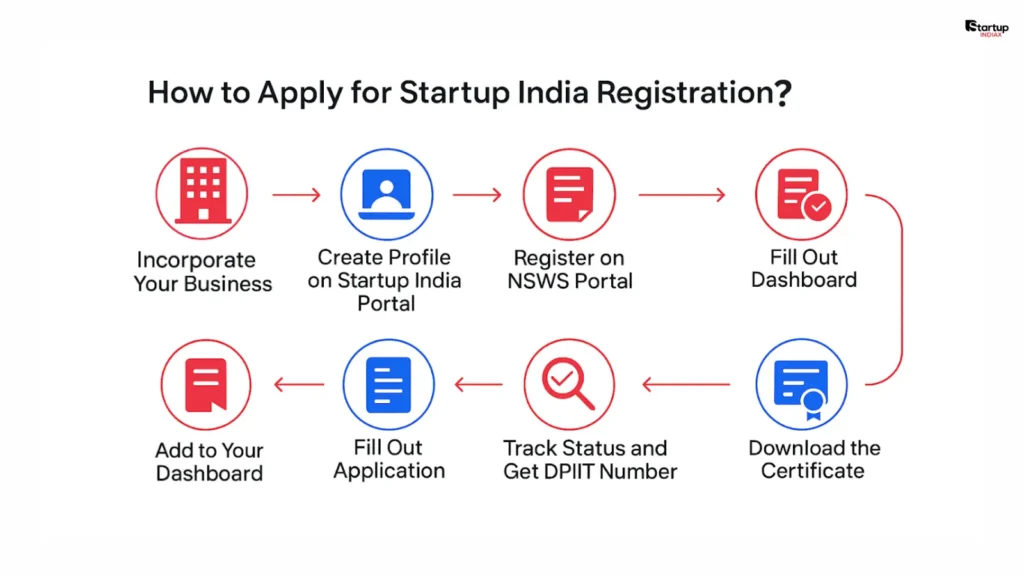

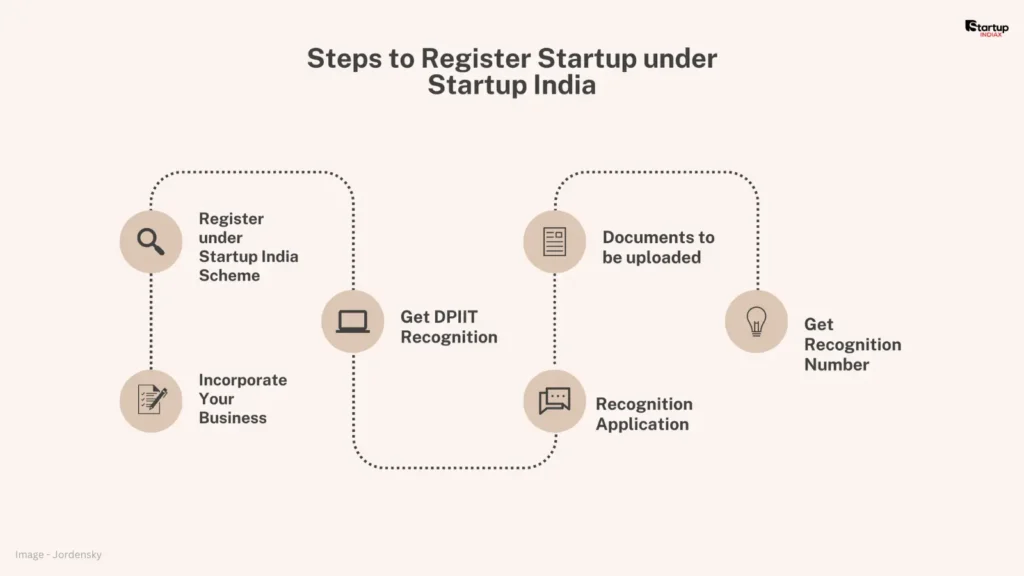

Proceeds will go to hybrid center expansion, tech upgrades, acquisitions, and further building the PhysicsWallah brand.

What is the current valuation of Physics Wallah?

The IPO places PhysicsWallah’s market cap at over ₹40,000 crore, with a $3.6 billion-plus valuation.